do nonprofits pay taxes on interest income

Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and. There are both pros and cons to using this form.

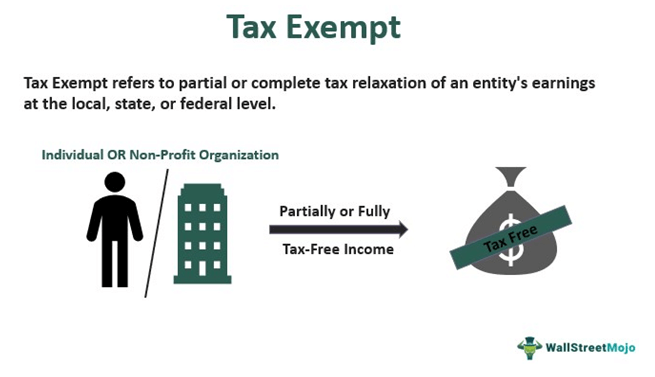

Tax Exempt Meaning Examples Organizations How It Works

Federal Unemployment Taxes FUTA taxes are required from nonprofits but a 501 c 3 organization that is exempt from income taxes is exempt from FUTA.

. This is because nonprofits are typically organizations that exist for public and private interest with no interest in making a. Nonprofits typically dont have to pay federal income taxes. Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of.

Your recognition as a 501 c 3 organization exempts you from federal income tax. For example if a nonprofit purchased 10000 worth of 10 percent bonds using 6000 cash and. Most nonprofits do not have to pay federal or state income taxes.

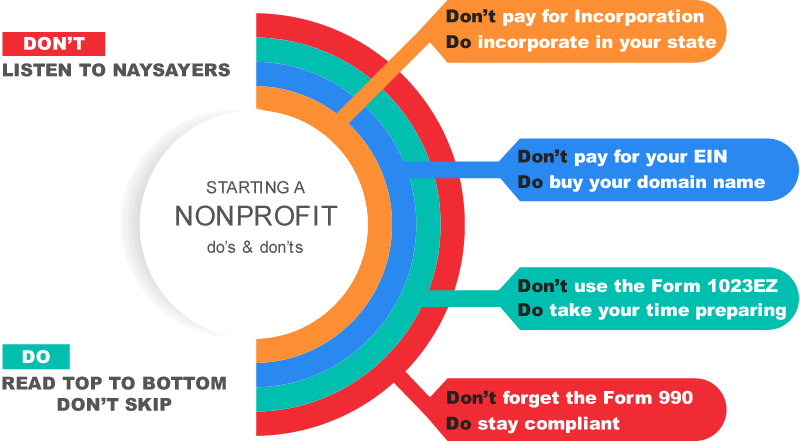

However here are some factors to consider when. An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

For instance HOAs that file this form experience a lower tax rate 15 for the first 50000 of net income. An organization must pay estimated tax if it. The nonprofit must recognize taxable income in the proportion that the property is financed.

They do not have to file a. May not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare. Do Nonprofits Pay Taxes.

This includes some disaster. Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two. Do nonprofits have to pay taxes on investment income.

As long as a 501 c 3 corporation maintains its eligibility as a tax-exempt organization it will not have to pay tax on any profits. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. All corporations can file their.

Ad Find out what nonprofit tax credits you qualify for and other tax savings opportunities. However this corporate status does not. Just because you have a tax-exempt status it does not mean that youre well tax.

Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it. Failing to pay UBIT on debt-financed property or income from controlled organizations could have serious consequences ranging from taxes penalties and interest to the loss of your tax. But nonprofits still have to pay.

Nonprofits are organizations that operate for the collective public and private interest without aiming to generate profits for the founders. Yes nonprofits must pay federal and state payroll taxes. Entities organized under Section 501 c.

On the downside though it subjects. June 30 2021. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items.

Taxable if Income from any item given in exchange for a donation that costs the. Do nonprofit organizations have to pay taxes. Did you know that sometimes nonprofits must pay income tax.

Get a personalized recommendation tailored to your state and industry.

How Current Us Tax Policy Impacts Donors And Nonprofits

Attention Small Nonprofits If You Care About Your Employees Help Them Retire Rvc

For Nonprofits Montana Department Of Justice

Irs Joins Nonprofit Groups To Promote 600 Charitable Tax Deduciton

501 C 3 Vs 501 C 6 A Detailed Comparison For Nonprofits

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

The Nonprofit Sector In Brief 2019 National Center For Charitable Statistics

Starting A Nonprofit How To Start A 501c3 Non Profit

Dissolving A Nonprofit Corporation National Council Of Nonprofits

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit

Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes Blue Avocado

How To Start A Nonprofit Legalzoom

Can A Nonprofit Business Earn Interest On A Checking Account

Non Profit Vs Not For Profit Top 6 Best Differences With Infographics

/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

Do Nonprofit Organizations Pay Taxes

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Irs Form 990 Filing Instructions And Requirements For Nonprofits