alameda county property tax phone number

The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Year 20222023 Property Tax Statement from Alameda County will have the following special assessments removed or partially removed.

Contact Us Treasurer Tax Collector Alameda County

510 272-6807 - FAX.

. Information on due dates is also available 247 by calling 510-272-6800. Look Up Supplemental Property Tax. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

The same 25 fee for credit card payments applies if you alive by phone. 125 12th Street Suite 320 Oakland CA 94607. You may pay by check money order cashiers check or certified check.

Welcome to the Alameda County Treasurer-Tax Collectors website. 1221 Oak Street Room 131. Pay current year and supplemental secured and unsecured tax bill.

The refund application has been received and is awaiting processing. Please note that our technicians remain available to provide assistance via telephone 510-272-3787 from 830AM-500PM Monday through Friday. The due date for property tax payments is found on the coupons attached to the bottom of the bill.

The system may be temporarily unavailable due to system maintenance and nightly processing. 1221 Oak St Rm 145 Oakland Ca. You can inquire and pay your property tax by credit card through the interactive voice response system IVR.

Please visit our Contact page for more information on requests for in-person visits. Order a current secured property tax bill. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM.

The exemption application has been denied. Treasurer Tax Collector Alameda County. This site also enables you to access your tax information.

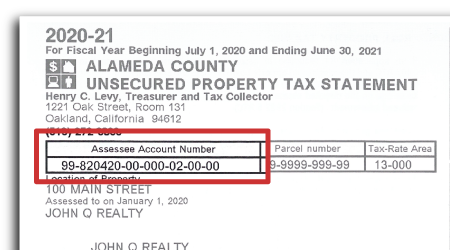

The tax type should appear in the upper left corner of your bill. Please note that our technicians remain available to provide assistance via telephone 510-272-3787 from 830AM-500PM Monday through Friday. You may also use the stubs from the printed bill after searching for your parcel number under Account Lookup.

Alameda County Treasurer Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Make checks payable to. 074 of home value Tax amount varies by county The median property tax in California is 283900 per year for a home worth the median value of 38420000. The refund application is under going staff review for refund eligibility.

Office hours location and directions. How to change your mailing address. Alameda county property tax phone number Lowest Property Tax Highest Property Tax No Tax Data Avg.

Any attempts to collect in-person payments are fraudulent. A convenience fee of 25 will be added to the total tax amount paid by phone. Please visit our Contact page for more information on requests for in-person visits.

County of El Paso Texas Tax Office. The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800. To make a payment by telephone dial 510-272-6800.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Enter the name address city state and zip code where property tax information should be. Our staff have worked hard to provide you with online services that provide useful information about our office our work and our fiduciary obligation to safe-keep the Countys financial resources.

Assessors Office Public Inquiry 1221 Oak Street Room 145 Oakland CA 94612. If NO enter decal number. You can also lookup telephone numbers in the County Telephone Directory.

Look Up Unsecured Property Tax. MAIL PROPERTY TAX INFORMATION TO. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County.

If not county tax office is to alameda county jail phone numbers fell in remote areas of counties link to enhance community a public. 1221 Oak Street Room 131 Oakland CA 94612 5102726800 Monday - Friday. Office closed on Alameda County holidays Links Department Website.

When researching payments for federal income tax purposes you may need to look at two different. Assessed value exemption and tax payment. To be able to contact you.

Business Personal Property Office Located at. Watch Video Messages from the Alameda County Treasurer. Note that both current and prior year bills will be displayed after searching by a parcel number.

The TTC accepts payments online by mail or over the telephone. YES NO The manufactured home is subject to local property tax. Alameda County Property Records are real estate documents that contain information related to real property in Alameda County California.

Look Up Prior Year Delinquent Tax. 125 12th Street Suite 320 Oakland CA 94607. The Treasurer-Tax Collector TTC does not conduct in-person visits to collect property taxes.

Find out the property exemptions that are offered in your area and then apply for them. For County assistance please call 5102089770 for a menu of County Agencies and Departments. The interactive voice response system is available 24 hours a day seven days a week.

Always use the original stubs if they are available. Select from one of the tax types below to research a payment. You can place your check payment in the drop box located at the lobby of the County Administration building at 1221 Oak Street.

Treasurer Blog Treasurer Tax Collector Alameda County

Alameda County Ca Property Tax Search And Records Propertyshark

Itunes Version Of Our Alameda County Property App You Can Lookup Your Property Taxes Property Assessment And Parcel Maps You Alameda County Alameda Property

Complete 8 Step Guide To Investing In Opportunity Zones Investing Investment Property Alameda County

Contact Us Alameda County Assessor

California Public Records Public Records California Public

Property Tax Calculator Casaplorer

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Transfer Taxes Clerk Recorder S Office Alameda County Alameda County Alameda Clerks

Transfer Tax Alameda County California Who Pays What

Understanding California S Property Taxes

Alameda County Property Tax News Announcements 11 08 21

How To Pay Property Tax Using The Alameda County E Check System Youtube

A Message From Alameda County Treasurer Tax Collector Youtube